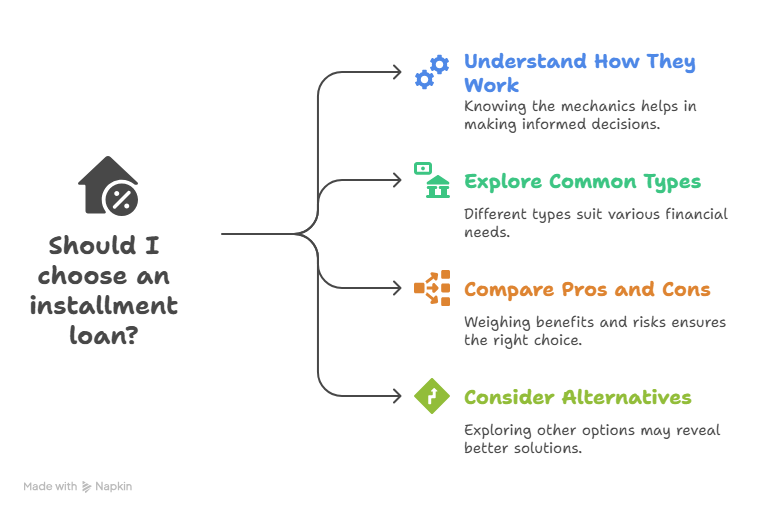

Introduction

Installment loans are one of the most common forms of borrowing, but many people aren’t sure how they actually work or what makes them different from other types of credit.

Whether you’re thinking about financing a car, covering an unexpected expense, or simply curious about your options, understanding installment loans can help you make smarter financial decisions.

Why does this matter? Every loan comes with risks and benefits. Not all borrowing options fit every situation, and a choice made without clear information can lead to extra costs or financial stress down the road.

In this article, you’ll find clear answers to the biggest questions about installment loans. We’ll define what they are, break down their key features, explore the most common types, compare pros and cons, explain when they make sense, look at alternatives, and highlight what to consider before you apply.

By the end, you’ll have the unbiased information you need to decide if an installment loan is the right move for your finances.

What to know before taking an installment loan

- Predictable payments are a plus, but the total cost can be higher than you expect if you’re not paying attention.

- There isn’t just one kind of installment loanpersonal, auto, mortgage, BNPL and each works differently with its own risks.

- Amortization matters: early payments go mostly to interest, which affects how quickly you build equity or reduce debt.

- They can be smart for big purchases, debt consolidation, or credit building, but can backfire for non-essentials or mismatched terms.

- Alternatives (credit cards, HELOCs, BNPL) may look easier, but each has trade-offs to weigh before choosing.

- Approval isn’t everything: fees, fine print, and lender reputation can make or break whether the loan helps or hurts you.

Disclaimer: This site contains affiliate links. If you make a purchase, we may earn a commission at no extra cost to you.

What Is an Installment Loan?

Clear Definition in Layman’s Terms

An installment loan is a type of loan where you receive a lump sum of money from a lender and agree to pay it back over time in regular, fixed payments. These payments are usually made monthly and continue until the loan and all interest are fully paid.

Key Components: Principal, Term, Interest Rate, Monthly Payment

- Principal: The total amount you borrow from the lender.

- Term: The set amount of time you have to repay the loan, such as 12, 36, or 60 months.

- Interest Rate: The cost charged by the lender for borrowing money, typically expressed as an annual percentage rate (APR). The rate may be fixed or variable.

- Monthly Payment: The fixed amount you pay each month, which includes a portion of the principal and interest.

How Installment Loans Differ from Revolving Credit

Unlike revolving credit (such as a credit card), an installment loan gives you a one-time sum to repay on a set schedule. You cannot re-borrow on the same account after paying it down. Revolving credit allows you to borrow, repay, and borrow again within your credit limit making it more flexible but often less predictable in cost.

| Feature | Installment Loan (e.g., Personal Loan) |

Revolving Credit (e.g., Credit Card) |

|---|---|---|

| Purpose | Used for a specific, large purchase or expense (e.g., car, home, debt consolidation). | Used for everyday purchases or as an emergency fund. |

| Loan Amount | A single, lump sum of money is received upfront. | A credit limit is established, and you can borrow up to that amount over time. |

| Repayment | Fixed monthly payments over a set period (term). | Variable monthly payments based on your outstanding balance. |

| Term | A predetermined length of time, such as 12, 36, or 60 months. Mortgages can be 15 or 30 years. | No set term. The account stays open as long as you make payments. |

| Interest Rate | Often a fixed interest rate, so the rate doesn’t change over the life of the loan. | Typically a variable interest rate that can change with market conditions. |

| Total Debt | Total debt outstanding for personal loans in the U.S. is about $253 billion as of Q1 2025. | Total debt outstanding for credit cards in the U.S. is about $1.18 trillion as of Q1 2025. |

| Average Interest | The average personal loan interest rate is approximately 12.64%. | The national average APR for credit cards is over 21%. |

Common Types of Installment Loans

Installment loans come in many forms, each serving different needs. Some of the most common types include:

Personal Loans

Personal loans are unsecured loans you can use for almost any purpose, such as consolidating debt, covering medical bills, or funding a major purchase. They don’t require collateral, and borrowers repay them in fixed monthly payments over a set term, often two to five years.

Auto Loans

Auto loans are used specifically to finance the purchase of a vehicle. These loans are usually secured by the car itself, which means the lender can repossess the vehicle if the borrower fails to make payments. Repayment terms typically range from three to seven years, with equal monthly payments.

Mortgages

A mortgage is a long-term loan designed for buying real estate, such as a house. Mortgages are secured by the property, and terms often stretch from 15 to 30 years. Borrowers make regular monthly payments that include principal and interest, and the lender can foreclose on the property if payments are missed.

Student Loans

Student loans help cover the cost of higher education, including tuition, fees, and living expenses. They can be offered by the government or private lenders. Repayment usually begins after graduation, and terms can range from five to twenty years, with fixed monthly payments.

Buy-Now-Pay-Later (BNPL) Services

BNPL services allow consumers to break up a purchase into several equal payments, often with little or no interest if paid on time. These short-term installment plans are commonly used for online shopping, giving buyers flexibility while spreading out the cost.

💸 Types of Installment Loans at a Glance

Installment loans vary widely in purpose and structure. Some help with everyday needs, others cover major life purchases. Here’s a streamlined breakdown of the most common types:

| Loan Type | Best For | Typical Term | What to Expect |

|---|---|---|---|

| Personal Loan | Debt consolidation, medical bills, or large purchases | 2 – 5 years | Flexible use, higher rates if credit is poor |

| Auto Loan | Buying a new or used vehicle | 3 – 7 years | Secured by the car; risk of repossession if unpaid |

| Mortgage | Purchasing or refinancing a home | 15 – 30 years | Long-term, lowest rates, but foreclosure risk |

| Student Loan | Covering tuition and education costs | 5 – 20 years | May offer deferred payments; federal loans safer |

| BNPL (Buy Now Pay Later) | Smaller retail purchases | Weeks – 12 months | Often 0% interest if paid on time; late fees can spike |

Key Takeaway: The right type of installment loan depends on your goal and repayment ability. Long-term loans like mortgages build stability but carry big risks, while short-term BNPL plans can be convenient but dangerous if mismanaged.

How Installment Loans Work in Practice

The process of getting and repaying an installment loan is straightforward, but it helps to know exactly what happens at each step.

The Borrowing and Repayment Process

First, you apply for a loan and the lender reviews your application, checking your credit, income, and overall financial situation. If approved, you receive a lump sum of money. From that point, you agree to repay the loan over a fixed term, often several years by making regular, scheduled payments.

Each payment includes part of the principal (the amount you borrowed) and interest (the lender’s charge for letting you use the money). You keep making payments until the loan is fully paid off.

Interest Calculation: Fixed vs. Variable Rates

Most installment loans use either a fixed or variable interest rate.

- Fixed rate: The interest rate stays the same throughout the loan’s term. Your monthly payment won’t change, making budgeting easier.

- Variable rate: The interest rate can change at certain intervals, which may cause your payment amount to go up or down. Variable rates are less common for personal loans but can apply to certain types, such as some mortgages or student loans.

Amortization and Monthly Payments Explained Simply

Installment loans are usually “amortized,” meaning each payment covers both interest and a portion of the principal.

Early payments go more toward interest, but over time, more of your payment reduces the principal. When the last payment is made, the loan balance is zero and the account is closed.

Knowing these basics helps borrowers understand what to expect and how to plan for each stage of the loan.

🚫 Pros and Cons of Installment Loans

Before you apply, it’s important to weigh the advantages against the drawbacks so you know whether this type of borrowing truly fits your situation.

| Factor | Pros | Cons | What It Means for You |

|---|---|---|---|

| Payments | Fixed monthly payments make budgeting easier | Missed payments can quickly hurt your credit | Predictable structure helps, but discipline is key |

| Flexibility | Can be used for many purposes (personal loans, debt consolidation, etc.) | Once approved, you can’t re-borrow without a new loan | Good for one-time needs, not ongoing borrowing |

| Interest Rates | Often lower than credit cards (especially with good credit) | Higher for poor credit; longer terms increase total interest | Great if you qualify for competitive rates |

| Credit Impact | On-time payments build credit history | Defaults or late payments damage credit and may lead to collections | A chance to strengthen or weaken your credit profile |

Key Takeaway: Installment loans are powerful tools when used responsibly, offering structure and predictability. But if repayment discipline is an issue, they can become costly and harmful to your financial health.

When Does an Installment Loan Make Sense?

An installment loan can be a helpful financial tool, but it’s not right for every situation. Here’s when it tends to make the most sense and when you should be cautious.

Best-Case Use Scenarios

- Large, Planned Expenses: If you need to finance a major purchase, such as a car, home improvement, or a medical bill, an installment loan can provide the necessary funds with predictable payments.

- Debt Consolidation: When you have high-interest debts, especially from credit cards, using an installment loan to consolidate those balances can simplify payments and potentially lower your overall interest rate.

- Building Credit: Making on-time payments on an installment loan can help improve your credit score by demonstrating responsible borrowing behavior.

When to Be Cautious

- Borrowing for Unnecessary Purchases: Using an installment loan for non-essential spending can lead to long-term debt that’s hard to manage.

- Debt Consolidation Without Changing Habits: Consolidating debt only works if you avoid racking up new balances on your credit cards or other loans afterward. Otherwise, you could end up deeper in debt.

- Relying on Long Repayment Terms: Lower monthly payments over a longer term can be appealing, but this often means paying more interest in total.

Before taking out an installment loan, it’s smart to review your budget, consider the total cost, and be sure you have a clear plan to repay.

⚠️ Common Mistakes with Installment Loans

Even though installment loans are straightforward, borrowers often make mistakes that cost money or damage credit. Here are the most common ones to watch out for:

| Mistake | Why It’s a Problem | Better Approach |

|---|---|---|

| Borrowing More Than Needed | Larger loans = higher monthly payments and more interest over time | Only borrow the minimum amount necessary to cover your expense |

| Focusing Only on the Monthly Payment | Long terms lower monthly costs but increase total interest paid | Compare total repayment costs, not just the installment size |

| Ignoring Fees and Penalties | Origination fees, late fees, or prepayment penalties add up quickly | Read the loan agreement carefully and ask about hidden charges |

| Missing or Late Payments | Hurts credit score and may trigger collection activity | Set up autopay or reminders to avoid missed due dates |

| Using Loans for Non-Essential Spending | Turns short-term wants into long-term debt obligations | Reserve installment loans for necessary, high-value expenses |

Key Takeaway: Most mistakes with installment loans come down to poor planning or lack of awareness. By borrowing only what you need, understanding the full costs, and staying disciplined with payments, you can avoid debt traps and use installment loans to your advantage.

Alternatives to Installment Loans

Installment loans aren’t the only borrowing option available. Depending on your needs, other forms of credit might offer more flexibility, lower costs, or better suit your situation. Here are some common alternatives:

Credit Cards

Credit cards are a form of revolving credit, meaning you can borrow, repay, and borrow again up to your credit limit. They can be convenient for short-term or smaller expenses, and some offer rewards or cash back. However, credit cards typically have higher interest rates than installment loans, especially if you carry a balance from month to month.

Home Equity Lines of Credit (HELOCs) or Home Equity Loans

If you own a home, a HELOC or home equity loan allows you to borrow against your property’s value. These options may provide larger amounts and lower rates compared to unsecured loans, but your home is at risk if you can’t repay.

Buy-Now-Pay-Later (BNPL) Platforms

BNPL services let you split purchases into smaller payments, often with little or no interest if paid on time. These are useful for managing smaller, short-term expenses, but missing payments can lead to fees and impact your credit.

Payday Loans

Payday loans are short-term, high-interest loans meant to be repaid with your next paycheck. They’re usually easy to get but come with extremely high costs and fees. Most financial experts advise avoiding payday loans unless you have no other options.

🔄 Installment Loans Alternatives at a Glance

If an installment loan doesn’t fit your situation, there are other financing options. Each comes with its own pros, cons, and ideal use cases.

| Alternative | Best For | Pros | Cons |

|---|---|---|---|

| Credit Cards | Short-term or smaller expenses | Flexible borrowing, rewards programs, revolving access | High interest if balances carry over, risk of overspending |

| HELOC / Home Equity Loan | Homeowners needing large sums | Lower interest rates, higher borrowing limits | Your home is collateral; risk of foreclosure |

| BNPL Services | Retail or online shopping | Often 0% interest if paid on time, simple setup | Late fees add up; multiple BNPL plans can hurt credit |

| Payday Loans | Urgent cash with no other options | Fast approval, minimal requirements | Extremely high APRs; debt trap risk |

Key Takeaway: Alternatives can work in specific situations, but they often come with trade-offs. Credit cards and HELOCs are best for planned borrowing, while BNPL and payday loans should be used cautiously, if at all.

What to Consider Before Applying for an Installment Loan

Before you apply for an installment loan, it’s important to review all the key factors that could impact your finances. Careful consideration now can save you money and stress later.

Credit Score Impact

Lenders use your credit score to determine your eligibility and the interest rate you’ll be offered. A higher score usually means lower rates and better terms. Applying for a loan will result in a hard inquiry on your credit report, which may cause a slight, temporary drop in your score.

Interest Rate Shopping

Interest rates can vary widely between lenders. Compare offers from multiple banks, credit unions, and online lenders to find the best rate and loan terms for your situation. Even a small difference in the rate can make a big impact over the life of the loan.

Fees and Loan Terms

Read the fine print for any application fees, origination fees, late payment penalties, or prepayment penalties. Understand the total cost of the loan, not just the monthly payment. Make sure the repayment schedule fits your budget.

Choosing a Reputable Lender

Research potential lenders to ensure they are legitimate and have a strong reputation for customer service. Look for reviews, check for proper licensing, and avoid lenders that use high-pressure tactics or promise guaranteed approval without checking your credit.

Taking these steps before you apply can help you avoid surprises and ensure you choose a loan that fits your needs.

📋 How Do I Apply for an Installment Loan?

Applying for an installment loan is easier when you know what to expect. Follow these steps to improve your chances of approval and secure better terms:

| Step | What to Do | Why It Matters |

|---|---|---|

| 1 | Check Your Credit & Finances Review your credit report, score, income, and debts. |

Helps you understand what you can afford and which lenders to target. |

| 2 | Compare Lenders Look at banks, credit unions, and online lenders. Use prequalification tools when available. |

Ensures you find the best rates, terms, and eligibility requirements. |

| 3 | Gather Documents Prepare ID, proof of income, bank statements, and proof of residence. |

Having paperwork ready speeds up approval and avoids delays. |

| 4 | Prequalify (Optional) Use soft credit check tools to preview loan offers. |

Lets you shop around without hurting your credit score. |

| 5 | Submit Application Complete the full application and authorize a hard credit check. |

Officially starts the process and determines approval. |

| 6 | Review Loan Terms Carefully check APR, fees, and repayment schedule before signing. |

Protects you from surprise costs and ensures the loan fits your budget. |

| 7 | Accept & Receive Funds Sign the agreement and get money deposited (usually 1–5 days). |

Finalizes the loan and gives you access to the funds. |

Final Word: Being organized at every step from checking your credit to reviewing terms makes the process smoother and reduces the risk of ending up with a loan that hurts your finances.

Conclusion

Installment loans are a common and often useful way to borrow money for planned expenses, big purchases, or debt consolidation. Because they offer predictable payments and clear terms, they can help you manage your finances with confidence. Still, every loan comes with costs and risks.

Before choosing an installment loan, review all your options, compare offers, and consider your long-term repayment ability. Understanding the pros, cons, and alternatives can help you make a choice that protects your budget and financial well-being.

The right information and a careful approach will help you decide if an installment loan is the best move for your situation.

Frequently Asked Questions About Installment Loans

What is the difference between an installment loan and a payday loan?

An installment loan lets you borrow a lump sum and pay it back in regular, scheduled payments over months or years. A payday loan is usually for a smaller amount, must be repaid in full on your next payday, and typically comes with much higher fees and interest.

Will applying for an installment loan hurt my credit score?

Applying for any loan triggers a hard inquiry on your credit report, which may lower your score slightly. Making on-time payments on your loan can improve your score over time.

Can I pay off my installment loan early?

Many lenders let you pay off your installment loan ahead of schedule. However, some may charge a prepayment penalty, so check your loan agreement for details.

Are installment loans available to people with bad credit?

Some lenders offer installment loans to borrowers with poor credit, but the interest rates are often much higher. Compare offers carefully and watch for predatory lending practices.

How much can I borrow with an installment loan?

Loan amounts vary widely based on the lender, your credit score, income, and the type of loan. Personal installment loans can range from a few hundred to tens of thousands of dollars.

What happens if I miss a payment?

Missing a payment may result in late fees and could hurt your credit score. Repeated missed payments can lead to default and more serious financial consequences.

Are the interest rates on installment loans fixed or variable?

Both types exist. Most personal installment loans have fixed rates, which means your payment won’t change. Some mortgages and other loans may use variable rates, which can fluctuate.

1 Comment

Personal Loan vs Line of Credit: Which Is Right for You - Look Up Loans · October 8, 2025 at 1:24 pm

[…] they are installment loans, they end once the balance is fully repaid. This structure makes them ideal when you know exactly […]